There has been new progress in the suspension of production at Myanmar's rare earth mines. According to industry insiders, the Myanmar rare earth mines, which have been closed for less than a month, have now ceased fire and entered negotiations. The mines are expected to resume production as early as this week, but full resumption may have to wait until a complete ceasefire is achieved.

An industry insider, who wished to remain anonymous, told reporters that due to the previous refusal of the Kachin Independence Army to mediate, most Chinese miners had already withdrawn to China by early November. The industry originally believed that resumption before the Chinese New Year was unlikely. "Even if Myanmar's rare earth mines continue to suspend production, the impact will not be significant. The domestic inventory of ion-adsorption ore is sufficient, and the prices of medium-heavy rare earths are relatively stable at present."

The insider also emphasized that there is still uncertainty about the resumption of production in Myanmar. The shift from the Kachin Independence Army's refusal to mediate to their willingness to negotiate may involve complex internal factors.

Surplus of Heavy Rare Earths, Q4 Pr-Nd Oxide Unlikely to Exceed 450,000 yuan/mt

Recently, the suspension of mining in Myanmar's rare earth mines due to conflict has led to a halt in extraction. The industry had generally expected that the reduction in Myanmar's rare earth supply would lead to a tight supply of rare earth raw materials in the market, not only pushing up market prices but also exacerbating uncertainties in the rare earth supply chain. As a result of this event, the A-share rare earth permanent magnets sector had previously surged collectively.

However, the current market situation contrasts sharply with expectations, as the prices of major domestic medium-heavy rare earth products have remained stable. What will happen to rare earth prices after the resumption of production in Myanmar?

According to statistics from the China Rare Earth Industry Association, as of November 12, the domestic market average prices for dysprosium oxide and terbium oxide were 1.74 million yuan/mt and 5.97 million yuan/mt, respectively. The price of dysprosium oxide remained unchanged from the market average on October 23 (the day the Kachin Independence Army announced control over Myanmar's rare earth mines in Kachin State), and the market average price of terbium oxide only slightly increased by 2.49% from October 23 to November 12.

"Due to the impact of the local rainy season, mining in Myanmar only resumed at the end of September, and then conflict broke out again in October. After the closure, most Chinese miners in the area had already withdrawn to China. If production cannot resume, the annual fees paid by Chinese miners this year will be wasted," said Yang Jiawen, a rare earth analyst at SMM, to reporters. "The current domestic inventory is relatively sufficient and can support until the end of Q1 next year. The closure of Myanmar for two to three months should not have a significant impact on the domestic market. Subsequently, miners may be reluctant to sell, but a shortage is unlikely. Meanwhile, the import volume of mines from Laos has significantly increased, with the current monthly import volume around 1,000 mt."

"This year's 'October peak season' basically did not exist, and after October, it entered a calm period for procurement. From past years, there is usually a market before the Chinese New Year for stocking up. Currently, downstream demand is weak, with small magnetic material factories scheduling orders only until mid-November, and large factories have no orders for December. Apart from a few leading magnetic material enterprises, most are small factories," said Yang Jiawen. "Currently, upstream wants to raise prices but cannot sell at higher prices; downstream wants to lower prices, but upstream does not provide low-priced goods, resulting in a stalemate. In the future, the price of Pr-Nd oxide is expected not to exceed 450,000 yuan/mt."

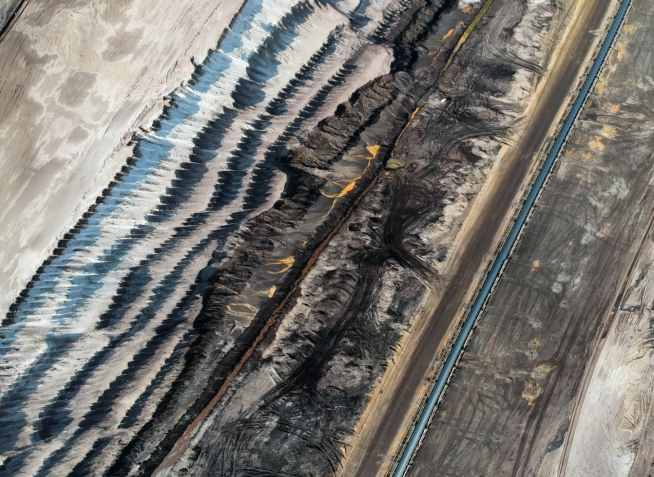

Data shows that since 2018, Myanmar has become an important source of rare earth mine imports for China, with annual import volumes increasing from over 20,000 mt initially to around 45,000 mt in 2023. According to the General Administration of Customs, from January to September this year, China imported 39,600 mt of rare earth mines and related products from Myanmar, accounting for about 39.54% of the total rare earth imports.

However, the aforementioned industry insider stated that the domestic supply of medium-heavy rare earths has always been in surplus, with current market consumption at a low level, leading to inventory accumulation and difficulty in significant price increases. "Currently, the monthly production of dysprosium and terbium oxides in China is around 200 mt and 40 mt, respectively. From our market survey, the production of dysprosium and terbium is generally in surplus, but this has little reference value for predicting market prices, as the price trends of dysprosium and terbium are mainly determined by market news, sentiment, and policies."

Divergence in Expectations, Polarization in the Magnetic Material Market

It should be noted that the impact of the obstruction of rare earth imports from Myanmar has led to a divergence in expectations between the upstream and downstream of the domestic rare earth industry chain.

As an investor, a reporter from CLS learned from several listed rare earth permanent magnet companies that upstream major rare earth enterprises believe that the situation in Myanmar has a significant impact on the supply of domestic medium-heavy rare earths. In contrast, downstream magnetic material enterprises stated that the impact is not significant because their rare earth raw materials are mainly supplied by China Northern Rare Earth (600111.SH) and China Rare Earth Group, with safety inventories usually maintained at 1-3 months.

Previously, a relevant person from China Northern Rare Earth told reporters that the import volume of rare earths from Myanmar accounts for a large proportion of domestic rare earth imports, and the reduction in supply from Myanmar mainly affects domestic medium-heavy rare earths. The impact of the situation in Myanmar is expected to last for some time.

Shenghe Resources (600392.SH) recently stated during an institutional investor survey that the uncertainty in Myanmar's situation will have a certain impact on the supply of rare earths, as a large proportion of domestic ion-adsorption ore is imported from Myanmar. If the port closure lasts for a long time, it may have a significant impact on the next step of ion-adsorption ore supply.

China Rare Earth (000831.SZ) stated during an institutional investor survey on November 12 that as a strategic minor metal, the prices of rare earth products are influenced by the supply-demand relationship and have always been volatile.

"The fluctuations in rare earth imports from Myanmar have a much greater impact on the capital market than on the company's production and operations. In our raw materials, the proportion of light rare earths is higher, and the use of medium-heavy rare earths is less. Currently, the company procures rare earth raw materials normally according to order conditions, and production has not been affected. Since the beginning of this year, the company's capacity utilisation rate has remained above 90%; as of now, the company's product sales have increased by more than 40% YoY," said a relevant person from JL MAG Rare-Earth (300748.SZ). "We are more concerned about the fluctuations in rare earth prices, but from the situation in the past few weeks, the situation in Myanmar has not directly led to a sharp rise in rare earth raw material prices."

The person further stated that, without considering other variables, according to the current development trend of the rare earth industry, the impact on the supply side of rare earths may be further weakened. "Because everyone is working on overcoming technical challenges, such as the grain boundary infiltration technology in the rare earth permanent magnet material industry, which aims to reduce the use of medium-heavy rare earths. Secondly, the technical level of rare earth product scrap recycling is also continuously improving. Currently, the amount of scrap recycling in our company accounts for about 30% of rare earth raw materials, and this proportion is increasing year by year."

A relevant person from Zhongke Sanhuan (000970.SZ) told reporters that the recent fluctuations in the capital market are quite significant and cannot be explained by a single reason. "It has no impact on us. Our company mainly procures raw materials from domestic rare earth enterprises. The dynamic inventory of raw materials is maintained at 2-3 months, and the company will adjust the procurement volume according to market prices to ensure a safe inventory level."

A relevant person from Zhenghai Magnetic Material (300224.SZ) told reporters that the domestic supply of medium-heavy rare earths is relatively sufficient, and the company's rare earth raw materials are mainly supplied by China Northern Rare Earth and China Rare Earth Group, with safety inventories generally maintained at 1-2 months, and the proportion of imports is relatively small, so the impact is not significant. China Northern Rare Earth recently stated during a survey by Cathay Fund that the market has shown a warming trend since August, with the prices of major rare earth products stabilizing and rising. China Rare Earth also recently stated that in Q4, the prices of some rare earth products have warmed up. However, the polarization in the magnetic material market is quite severe, with large enterprises' orders steadily increasing and production conditions stable, while small enterprises' orders have not seen significant growth, production conditions are poor, and there is a strong sentiment of wait-and-see among enterprises. "Source: Shanghai Metals Market"